Terms & Conditions

These Terms And Conditions (T&Cs) will serve as a basis for your (the customer) banking relationship with us. In these T & Cs, when we talk about ‘Mkobobank’, ‘Mkobo Digital Bank’, ‘we’, ‘us’, and ‘our’ we mean Mkobo Microfinance Bank Limited. We are a full-service digital microfinance bank that is duly licensed by the Central Bank of Nigeria (“CBN”) and the Nigerian Deposit Insurance Corporation (“NDIC”). Our registered office is at 13, Hughes Avenue, Alagomeji, Yaba, Lagos, Nigeria. These Terms and Conditions cover the use of the services provided by Mkobobank including but not limited to our website and Digital Bank App. Mkobo Digital Bank also refers to Mkobobank and Mkobo Digital Banking App. These T&Cs work alongside the terms and conditions for any product which we allow you to use via the Mkobobank (e.g., the terms for Earlypay, Mkolo, SingleView, etc). If there’s a conflict between these T&Cs and any product terms, the product terms will take precedence. You should read these T&Cs carefully before accepting them. A copy of these T&Cs is available on our website and our Mkobobank App. This document should be read along with our Privacy PolicyWho can use Mkobobank?

- These terms are applicable when you choose to open an account on Mkobo Digital Bank and we generate an account number for you.

- All updates will be reflected on our website and the Mkobobank app.

- You can open an account with us if you are at least 18 years old. If you’re under 18, your parent or legal guardian can open and run an account on your behalf until you are 18 years old. They will still be subject to these terms and conditions.

- To use Mkobobank, you must have a compatible device to access the full range of features (in these T&Cs, we call these “Devices”).

Access to the use of the Mkobo Digital Bank

- Banking regulations require us to verify your identity before we can open an account for you. You will need to provide the list of the minimum requirements below in compliance with CBN’s Tier 1 account opening KYC requirements. The provision of additional information such as valid ID and utility bills enables us to open an account without restrictions.:

- Bank Verification Number (BVN)

- Your name

- Telephone number

- Email address

- Place & date of birth

- Gender, etc.

- You confirm that you have provided us with the accurate and complete information requ ired to create your account and that you have supplied all documentation, photographs , and information that allow us to comply with our regulatory obligations.

- Providing false information of any kind may result in the freezing or termination of your account. Additionally, you are completely responsible for all activities that occur under the account and any other actions taken in connection with it

- In line with regulations, we perform due diligence on all accounts so it is your responsibility to keep your contact information up-to-date in your profile. You must ensure to update all account information when a change occurs.

- You can access your Mkobobank app on multiple devices; however, we will only send any SMS messages (including notifications) to your registered mobile number.

Keeping your account safe

- To keep your account secure you will need to set up security passcodes, passwords, PINs (security information), etc. As long as our systems have checked your identity by verifying your security information, we will assume that we are dealing with you and that you have agreed to us disclosing information to you and acting on any instruction without getting further confirmation from you.

- The biometric authentication on your Mkobobank app is performed by the biometric authentication module of your device, and we do not control the functionality of any mode of biometric authentication including fingerprint, touch ID or face ID.

- We make no representation or warranty as to the security of the biometric authentication function on your mobile device and we do not have access to your fingerprint(s) or facial recognition information. For more information on how the biometric functionality works for your mobile device, please refer to your device manufacturer’s support resources.

- You understand and agree that any fingerprint stored on your mobile device can be used to access your account with Mkobobank, therefore you shall take all reasonable measures to keep your mobile device and the password used to register your fingerprint(s), facial map, or other biometric data on your mobile device in your safe custody.

- Except where you are logging in or signing in to Mkobobank, we will never ask you to tell us your security information (e.g., by calling you or emailing you) so please don’t share them with anyone, even if they say they’re from us.

- You shall be fully responsible for and bear the risk of any accidental or unauthorized disclosure of your device and password to any other person or any unauthorized use of your mobile device and password by any other person.

- You must change your password and security information immediately they become known to someone else.

- You must call us as soon as you can if the device that you use with the (or which syncs to your device) to has been lost, stolen, or fraudulently accessed.

- You must also immediately notify us of any unauthorized uses of your account or any other breaches of security.

- We will not be liable for deductions or operations which occur as a result of a third-party accessing your account.

- Once your password and security information are given, they shall be sufficient confirmation of the authenticity of the instruction given.

- We are exempted from any form of liability whatsoever for complying with any or all instruction(s) given by means of your password and other security information if by any means your password and security information become known to a third party or otherwise become compromised.

- You shall be responsible for any instructions given by means of your password and security information. Accordingly, we shall not be responsible for any such fraudulent, duplicate, or erroneous information.

Fees & charges

- Our fees and charges are transparent. We will not charge you for opening or using your Mkobobank account. You can view the up-to-date schedule of our fees and charges by visiting our Fees and Charges Schedule.

Other Information

- We may at any time assign or transfer all or part of our rights and/or obligations under these T&Cs (including our right to payment of any money you owe) to any person. We can also disclose information held about you to such a person as far as reasonably necessary to help with the actual or potential assignment.

- We can enforce these or any other rights at any time, even if we haven’t insisted on enforcing them in the past.

Communication and notifications

- You consent to receive communications and notifications from us via SMS, phone call, email, push notifications, in-app notifications, and social media. You may opt out of receiving non-transactional communications, by following the directions in our e-mail to “Unsubscribe” from our mailing list.

- These notifications are meant for your consumption only and we will not be held liable if you suffer any loss or damage as a result of unauthorised access to the information sent.

- You hereby authorize us to access, store and use information from your device in line with our privacy policy.

- You also consent to receive mandatory SMS alerts directed by the Central Bank of Nigeria through push notifications and in-app notifications.

- You agree to defend, indemnify and hold harmless Mkobobank from and against all losses, liabilities, damages, claims and expenses, including attorney's fees, arising out of, relating to or resulting (directly or indirectly) by reason of such notifications.

- You can find out about how we use and protect your data in our Privacy Policy which we have provided to you and which can be found on our website.

Consent

- You consent to the restricting of your account and reporting to law enforcement agencies, including the Economic and Financial Crimes Commission (EFCC), the Nigerian Financial Intelligence Unit (NFIU), the Nigerian Police Force, etc. if any fraudulent activity is associated with the operation of your account.

- You consent to us providing your information to Credit Bureau Agencies as mandated by the Law and may be required from time to time.

- You consent to us reporting to Nigeria Inter-Bank Settlement Systems Plc (NIBBS) for an update on the Watchlist Database of the Nigerian Banking Industry and the CBN if any fraudulent activity is associated with the operation of your accounts

- You also consent to other uses as provided in the privacy policy.

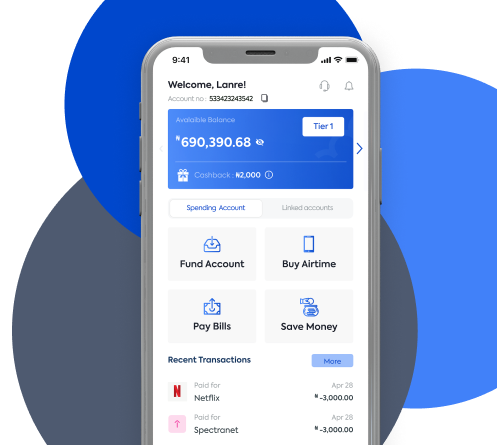

Spending Account

- Mkobo spending account is your main account tied to your NUBAN account number. The spending account is a savings account type which is used for all your day-to-day transactions. You can fund your Mkobobank spending account via bank transfers, debit cards and receive payments from your Employer and other third parties. You can also pay bills, make outward transfers to third parties or make payments using your Mkobo card. You can also transfer funds to your savings using the Mkolo Savings feature.

Mkolo

- Mkolo is the Target savings, fixed deposits and interest-yielding feature of Mkobobank. You can save for any financial goals easily using Mkobobank.

- Mkolo helps you save money with minimal effort. To do this, we can either debit your Mkobobank account at a user-determined frequency or you can make a one-time lump sum savings.

- Upon expiration of the tenor, your savings will be transferred to your Mkobobank account.

- You can make withdrawals prior to the expiration of the tenor.

- Please see the Mkolo product T&Cs on Mkobobank for more information.

Single view

- SingleView™ is an account Information Service feature of Mkobobank. This read-only Service aggregates all your account balances and transaction history to provide a single view on our Mkobobank (“the Service”).

- In connection with your use of the Service and as part of the functionality of the Service you would be required to link your other bank accounts (user accounts) to the service. Linking your user accounts to the service involves authentication by logging on to the online banking platform of the other bank accounts (users’ providers).

- The Service uses a third-party provider to access information from your user accounts i.e., your account balances and transaction history.

- You agree that you may be able to use the Service in conjunction with the Provider Services, and that Mkobo disclaims any and all liability whatsoever for any actions or inactions on the part of your provider(s) resulting in any inability to use the Service to access accounts, obtain data, download transactions, or otherwise use or access the Provider Services.

- You acknowledge and agree when you access data and information through the Service, we and the third-party provider access account number(s), password(s), security question(s) and answer(s), account number(s), login information, and any other security or access information, and the actual data in your user account(s) with such provider(s) such as bank and other account balances, debits and deposits as may be applicable (collectively, “Provider Account Data”), may be collected and stored in the Service.

- A fee will be charged for the Service whenever data is accessed and refreshed. The amount to be deducted will be displayed upon your request for access to the Service.

- You can view the up-to-date charges for accessing SingleView by visiting our Fees and Charges Schedule.

- Please see the T&Cs of the SingleView feature on Mkobobank for more information.

Earlypay

- Earlypay is a form of EWA (Earned Wage Access) which is a financial wellness product on Mkobobank. It provides employees with access to up to 50% of their accrued/earned salary at any time INTEREST-FREE! Earlypay breaks up the weekly, bi-weekly, or monthly pay cycles so workers can receive money that they've already earned before their salary date.

- The minimum withdrawal amount will be as displayed on the portal during the time of application.

- The maximum withdrawal amount will be as displayed on the portal during the time of application.

- You can view the up-to-date charges for accessing Earlypay by visiting our Fees and Charges Schedule. Please see the T&Cs of the Earlypay product on Mkobobank for more information...read more

Prohibited Uses

- In addition to other terms as set forth, you are prohibited from using the Mkobobank or its Content:

- To conduct any unlawful purpose;

- To solicit others to perform or participate in any unlawful acts;

- For any unsolicited or unauthorised advertising, promotional material, or any other form of spam;

- In any way that breaches any applicable local, national, or international law or regulation, or causes Mkobobank to breach any applicable law or regulation;

- To infringe upon or violate our intellectual property rights or the intellectual property rights of others; in any way that would locally or internationally evade any applicable taxes or facilitate tax evasion.

- To harass, abuse, insult, harm, defame, slander, disparage, intimidate, or discriminate based on gender, sexual orientation, religion, ethnicity, race, age, national origin, or disability;

- To submit false or misleading information;

- For the purpose of harming or attempting to harm minors in any way;

- For any obscene or immoral purpose;

- To deal in harmful programs such as viruses, spyware, or similar computer code designed to adversely affect the operation of any computer software or hardware;

- To upload or transmit viruses or any other type of malicious code that will or may be used in any way that will affect the functionality or operation of the Service or of any related mobile application, other mobile applications, or the Internet;

- To collect or track the personal information of others;

- To take advantage of or exploit a system bug or vulnerability, thereby causing unintended or unanticipated behaviours; or

- For a purpose that is contrary to its published specifications, instructions, and intended use.

- We reserve the right to terminate your use of the Service or any related mobile application for violating any of the prohibited uses.

Removing your access to Mkobobank

- We may stop you using close, suspend, freeze or limit access to your account, on occasions including but not limited to the following:

- Your account or the Digital Bank App is at risk;

- We suspect there’s unauthorised or fraudulent use; or

- There’s a risk that you won’t be able to repay any credit you’ve been given.

- The information we obtain from you does not comply with regulatory requirements;

- You do not meet, or are in breach of, the terms and conditions contained herein;

- You create risk or possible legal exposure to us;

- We are required to do so by law; or

- There is a report of, or our investigations reveal that you have engaged in, fraudulent or suspicious activity with your Mkobobank account.

- Mkobo is required to comply with local and international policies, and regulations against money laundering, terrorism funding, and conducting of businesses with entities/individuals situated in territories subject to trade sanctions and/or individually subject to such sanctions.

- Mkobo has to also comply with all extant laws in Nigeria, including the rules, regulations, guidelines, circulars, and letters issued by the CBN and other regulatory bodies from time to time.

- The implication of the preceding paragraph is that Mkobo is required to take steps to ensure that its customers’ accounts comply with the foregoing at all times and thus an account could be frozen, limited, or terminated for infractions of any of these mandates.

Closing your Mkobo Digital Bank Account

- You can close your account at any time and at no cost. If you’d like to do this, please see our FAQs.

- We reserve the right to close your account and to end this agreement if we, at our absolute discretion, consider that it has not been operated in a manner satisfactory to us, or if we believe that you have contravened any of these terms and conditions.

- We may take action to close your account without notice and to end this agreement immediately in any of the circumstances for which access to your account may be restricted by us and in cases where: (a) You, or someone else, are using the account illegally or for criminal activity; (b) It is inappropriate for a person authorized to give instructions on your account to operate it; (c) Your behaviour means that it is inappropriate for us to maintain your account; (d) You have not met our reasonable conditions and requests relating to identification and the provision of information about yourself and the activity (past, present or future) on any account or proposed account; (e) By maintaining your account we might break a law, regulation, code or other duty which applies to us; (f) By maintaining your account we may damage our reputation; or (g) You are or have been in serious or persistent breach of these terms and conditions or any additional conditions which apply to an account.

- However, we may keep some data after your account is closed or you cease to use our services for up to 7 years to comply with the law and if we face a legal challenge. In some circumstances, like cases of anti-money laundering or fraud, we may keep data longer if we need to (that’s in our legitimate interest) and/or the law says we have to. Please see the Privacy Policy for more information.

- You will, however, remain liable for any obligations related to your account with us. Once the account is closed, you will not be able to access any Mkobobank services.

Limitation of liability

- Mkobo makes no warranty that: I. The Mkobobank service will meet your requirements. II. The Mkobobank service will be uninterrupted, secure, or error free

- Under no circumstances will Mkobo be liable for any damages, losses or liabilities, including, without limitation, any lost profits, lost opportunity or any indirect, consequential, incidental, special, punitive, or exemplary damages, whether in contract, warranty, tort, (including negligence), strict liability, or otherwise, that arises out of or is in any way connected with, the use or inability to use, this site or any portion thereof, or any linked site, even if Mkobobank is advised of the possibility of damages, losses or liabilities.

- The Mkobobank platform is intended to be available through the public internet. We shall not be liable and make no warranties for access, speed or availability of the Internet or network services.

- We make no warranties that any of its our digital banking channels shall be fit for purpose or as to merchantability.

Indemnification

- You agree to defend, indemnify and hold harmless Mkobo and all of its respective Directors, Officers, Employees, Agents, Successors and Assigns, from and against all losses, liabilities, damages, claims and expenses, including attorney's fees, arising out of, relating to, or resulting (directly or indirectly) from your violation of these Terms of Use or misuse of Mkobobank’s products or services.

Liability for Refund

- Where we receive a notification that a payment from your account was not authorized by you, we will carry out an investigation and, as soon as we are reasonably satisfied that you did not authorize the payment, and that the payment was wrongly implemented by an error on the part of the Bank, we will refund the amount deducted.

- However, you will be liable for: I. All payments made from your account where you have acted fraudulently. II. Where the payment was made because you deliberately, negligently, or otherwise failed to keep your security information safe

- We would not be liable to you for any losses you suffer or costs you incur because: I. the details provided in the instruction provided were not correct; II. We cannot carry out our responsibilities under this agreement as a result of anything we cannot reasonably control. This shall also include, among other things, any machine, electronic device, hardware, or software failing to work. III. of our refusal to act on your instruction due to an order of court or a court judgement against you. However, a court order will not prevent us from using any right of set-off we may have using money which we hold for you

- You are informed that issuance of Dud Cheques constitutes a criminal offence under the Nigerian Law and we are obligated by virtue of Central Bank of Nigeria’s directive to submit details of customers who issue cheques on insufficiently funded accounts to the CBN for investigation and prosecution in line with the provisions of the Dishonoured Cheques (offences) Act LFN 2007

Claims

- If another person makes a claim for any of the funds in your account (for example, if someone takes legal action to recover funds they believe belong to them), or if we know or believe that there is a dispute involving someone else who owns or controls funds in the account, we may: (a) Put a hold on your account and refuse to pay out any funds until we are satisfied that the dispute has ended or (b) Send the funds to the person who we have good reason to believe is legally entitled to them; or (c) Continue to rely on the current records we hold about you; apply for a court order; or take any other action we feel is necessary to protect us.

- We will not be liable to you for taking any of the above steps

Setoff

- If any accounts you hold with us are in credit, we may use them to repay any amounts you owe us including but not limited to sums due on any other accounts you hold with us either in the same name(s) or in the case of corporate accounts, its affiliate, subsidiary or sister company’s accounts (whether or not in the same name), even if the accounts are in different currencies.

Bank Charges

- We will levy charges for the operation of the account in accordance with our Standard Tariff which shall be in the minimum, the maximum amount contained in the bankers tariff. We reserve the right to levy any reasonable charges for additional services whether or not contained in the bankers tariff in relation to managing your account in addition to those stated in the Standard Tariff or for providing you with more frequent information regarding the operation of your account.

- We may take any charges or interest you owe us from any account you hold with us.

- We may vary these charges from time to time in accordance with the terms stated herein.

Know your Customer

- We are obliged by law to confirm and verify the identity of each person who applies to open accounts with us. Hence, as part of our obligations to comply with applicable Anti- money laundering & Know Your Customer legislation, you may be required to provide certain Verification Documents (which shall typically include but are not limited to an identity card or passport, proof of residential address such as a recent utility bill, and proof of payment method and earnings).

- Mkobo is further obliged by law to conduct enhanced due diligence on you which may be triggered amongst other things by changes in your sources of income, unusual inflows into your account, negative news about your person or business etc.

- You agree that the Bank has the right to place restrictions on this account with or without notice to you in the event the documentation provided by you does not meet the KYC requirement or that the enhanced due diligence conducted by us on you is not satisfactory.

- You agree that this account shall not be used to receive proceeds of fraud and that Mkobo has the right to place restrictions on this account, as well as the sub-accounts (with or without notice to you) if it receives any report or has any suspicion that the account is being used for fraud.

- You agree that whenever required by Mkobo in the course of the banking relationship, you shall provide Mkobo with the following documents (‘Verification Documents’) and information: · Proof of Identity* (In case of legal persons, the Mkobo shall obtain adequate data and information so as to understand the ownership and control structure of the Customer). · Proof of the Client’s Residential Address* · Proof of source of earnings and inflows*. · Information and data that are used for the construction of your economic profile.

- Mkobo will accept a prospective or potential request for account opening only when it becomes fully satisfied that you comply with Know Your Customer and due diligence procedures to ensure that a new relationship with you does not negatively affect our reputation.

- Where you have been granted a waiver to allow time for you to provide documents required in furtherance of any due diligence, Mkobo has the right at any time after the expiration of the time allowed to suspend transactions on the account, including but not limited to immediately terminating the banking relationship.

Overdrafts

- If your account balance becomes overdrawn for any reason whatsoever without the prior approval and grant of credit by us to you, we shall apply a default rate on the overdrawn sum at the minimum rate of 45% per annum. The rate can be revised upwards at our sole discretion.

- You shall promptly upon demand, pay to Mkobo the amount of the overdraft plus, accrued interest until Mkobo has been fully reimbursed.

Changes to Terms and Conditions

- We may, at our discretion, change these terms and conditions (including our charges) and introduce changes to and charges for our services at any time. Notice of such changes would be provided prior to implementation.

Severability

- In the event any of the terms or provisions of these Terms of Use shall be held to be unenforceable, the remaining terms and provisions shall be unimpaired, and the unenforceable term or provision shall be replaced by such enforceable term or provision as comes closest to the intention underlying the unenforceable term or provision.

Governing law and jurisdiction

- These Terms of Use constitute a contract between you and Mkobo. You agree that your use of Mkobobank shall be governed by, and construed in accordance with, the laws of the Federal Republic of Nigeria. You expressly agree to submit to the sole and exclusive jurisdiction of the state and federal courts in Nigeria.

Complaints/ Contact Us

- If you’re not happy with any product or service you’ve received, please contact us via the in-app chat or (see the “Contact Us section”) below.

Acceptance of these terms

You acknowledge that you have read this Agreement and agree to all its terms and conditions. By using the Mkobo Digital Bank or its Services you agree to be bound by this Agreement. You also agree that the information supplied is true and correct. By opening an account with us, you consent to our carrying out regular identity and fraud prevention checks.© 2022 Mkobo Microfinance Bank (RC1234231). All rights reserved. All deposits are insured by the Nigerian Deposit Insurance Corporation (NDIC). Mkobo Microfinance Bank is licensed by the Central Bank of Nigeria. “Mkobo” and “Mkobobank” are trademarks of Mkobo Microfinance Bank Limited: 13 Hughes Avenue, Alagomeji, Yaba, Lagos. All text, graphics, audio files, code, downloadable material, and other works on this website are the copyrighted works of Mkobo Microfinance Bank. All Rights Reserved. Any unauthorized redistribution or reproduction of any copyrighted materials on this website is strictly prohibited. Other product and company names are trademarks of their respective owners. This website contains simulated images; actual appearance may vary.